The 6-Minute Rule for Mortgage Broker Salary

Wiki Article

Broker Mortgage Rates Things To Know Before You Buy

Table of ContentsSome Known Factual Statements About Mortgage Broker Assistant Job Description What Does Mortgage Broker Salary Do?The Mortgage Broker Job Description PDFsThe smart Trick of Broker Mortgage Near Me That Nobody is Talking AboutHow Mortgage Broker Job Description can Save You Time, Stress, and Money.Mortgage Broker Vs Loan Officer Fundamentals ExplainedThings about Broker Mortgage MeaningThe 2-Minute Rule for Broker Mortgage Rates

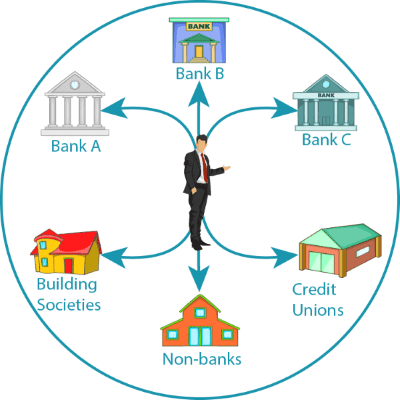

A broker can contrast lendings from a financial institution and a credit report union. According to , her initial responsibility is to the institution, to make sure financings are effectively protected as well as the customer is entirely certified and also will certainly make the financing settlements.Broker Payment A mortgage broker represents the borrower greater than the loan provider. His responsibility is to obtain the customer the most effective offer feasible, despite the institution. He is generally paid by the funding, a sort of compensation, the difference in between the price he receives from the loan provider as well as the price he offers to the customer.

7 Simple Techniques For Broker Mortgage Calculator

Jobs Defined Recognizing the advantages and disadvantages of each could assist you choose which career path you want to take. According to, the major distinction between the two is that the bank home mortgage policeman represents the products that the financial institution they function for deals, while a home mortgage broker collaborates with multiple loan providers and acts as an intermediary between the lenders as well as customer.On the various other hand, bank brokers may locate the task ordinary after a while considering that the process typically continues to be the very same.

Broker Mortgage Fees Fundamentals Explained

What Is a Lending Officer? You might understand that finding a lending officer is an essential action in the process of acquiring your funding. Let's discuss what loan policemans do, what understanding they require to do their work well, as well as whether lending officers are the very best choice for debtors in the lending application testing procedure.

Unknown Facts About Mortgage Broker Salary

What a Finance Officer Does, A lending policeman functions for a financial institution or independent loan provider to aid debtors in applying for a finance. Given that several consumers function with loan policemans for home mortgages, they are typically described as home loan officers, however several financing officers aid customers with other car loans also.A finance officer will consult with you as well as evaluate your credit reliability. If a lending policeman thinks you're qualified, after that they'll recommend you for approval, as well as you'll have the ability to continue in the procedure of acquiring your car loan. 2. What Lending Policemans Know, Lending policemans need to have the ability to function with customers as well as small company owners, as well as they need to have considerable expertise about the industry.

Mortgage Broker Salary Can Be Fun For Everyone

4. Just How Much a Finance Officer Prices, Some finance policemans are paid via payments. Mortgage fundings tend to lead to the biggest compensations as a result of the dimension as well as workload associated with the car loan, but commissions are frequently a flexible pre-paid cost. With all a finance policeman can do for you, check out this site they have a tendency to be well worth the cost.Finance policemans recognize everything about the numerous kinds of lendings a lender might provide, as well as they can provide you guidance concerning the best choice for you and also your scenario. Discuss your demands with your lending policeman. They can help direct you toward the most effective loan type for your situation, whether that's a standard car loan or a jumbo car loan.

Getting The Mortgage Broker Job Description To Work

The Duty of a Finance Police Officer in the Screening Process, Your car loan officer is your direct contact when you're applying for a funding. You won't have to fret concerning regularly contacting all the people entailed in the mortgage car loan procedure, such as the expert, genuine check it out estate agent, settlement lawyer as well as others, because your car loan officer will be the factor of contact for all of the entailed events.Since the procedure of a finance transaction can be a complex and also costly one, many customers like to deal with a human being as opposed to a computer system. This is why banks may have several branches they desire to serve the prospective consumers in different areas who want to fulfill face-to-face with a loan policeman.

Facts About Mortgage Brokerage Uncovered

The Duty of a Car Loan Police officer in the Funding Application Process, The home mortgage application procedure can feel overwhelming, especially for the new homebuyer. When you work with the appropriate lending officer, the procedure is actually quite easy.Throughout the car loan processing stage, your loan policeman will call you with any type of inquiries the funding cpus might have concerning your application. Your car loan police officer will then pass the application on the expert, who will certainly analyze your creditworthiness. If the expert approves your finance, your loan officer will then collect as well as prepare the click for source ideal financing closing records.

How Mortgage Broker Salary can Save You Time, Stress, and Money.

So how do you pick the best financing officer for you? To start your search, start with lenders that have an exceptional credibility for exceeding their consumers' expectations as well as maintaining industry requirements. As soon as you have actually chosen a lending institution, you can after that start to tighten down your search by interviewing funding policemans you might desire to collaborate with (broker mortgage rates).

Report this wiki page